Introduction

According to market research, the global energy storage market size is projected to reach $136 billion by 2025, compared to $86 billion in 2023, reflecting a growth of over 58%. The installed capacity of energy storage systems is expected to increase from 50GW in 2023 to 75GW in 2025, with an annual growth rate of 22%. This significant expansion is driven not only by the large-scale integration of renewable energy but also by policy incentives related to global carbon neutrality targets.

As the industry scales rapidly, the energy storage market is becoming a cornerstone of the energy transition. What technologies are propelling this transformation? By analyzing both product performance improvements and market-driven demands, we explore the 2025 energy storage battery market trends and the emerging technologies poised to reshape the landscape.

I. Market Trends from the Perspective of Energy Storage Products

1. High-Energy-Density Battery Technology: Overcoming Traditional Limitations

In 2025, breakthroughs in energy density will be a major driver of the energy storage industry’s growth.

- Solid-State Batteries: Solid-state batteries replace liquid electrolytes with solid materials, offering significantly enhanced safety and 30%-50% higher energy density compared to traditional lithium-ion batteries. These batteries are expected to achieve commercial viability and gain traction in residential energy storage and EV markets by 2025.

- Innovative Materials: Silicon-carbon anodes, with 5-10 times the capacity of conventional graphite anodes, are key to enabling more compact and cost-effective energy storage systems.

2. Extended Lifespan and Deep-Cycle Performance: Lowering Total Cost of Ownership

Improved lifespan and deep-cycle capabilities are essential to reducing the overall operating costs of energy storage systems.

- Technological Advancements: New electrolyte additives and advanced cathode materials (e.g., lithium iron manganese phosphate) are enabling cycle life improvements from 3,000 to over 6,000 cycles, with deep-cycle performance rising from 80% to over 90%.

- Practical Applications: These advancements enhance the reliability of energy storage solutions for residential and industrial use. For instance, a 30kWh residential energy storage system with an extended lifespan can reduce per-kWh costs by 30%.

3. Fast Charging and Discharging: Meeting Dynamic Energy Needs

Enhanced fast-charging and discharging capabilities are critical to addressing the dynamic requirements of future energy grids.

- Technological Focus: High-power lithium battery solutions, dual-ion batteries, and hybrid systems with supercapacitors are being developed to significantly improve charge/discharge rates. Systems capable of fully charging within 5-10 minutes are becoming increasingly feasible.

- Market Applications: These technologies can reduce response times in grid-frequency regulation and peak shaving, improving overall grid stability.

4. Modular and Standardized Designs: Facilitating Market Adoption

- Modular Designs: Modular battery pack designs simplify system installation and maintenance while accelerating deployment. For example, Tesla’s Powerwall series allows users to scale systems based on specific needs.

- Standardized Systems: The International Electrotechnical Commission (IEC) standards for energy storage products are driving global consistency and compatibility. By 2025, approximately 80% of energy storage products are expected to adopt unified, standardized designs.

5. Intelligent and Digitalized Management Systems

The development of intelligent energy storage systems is transforming efficiency and safety.

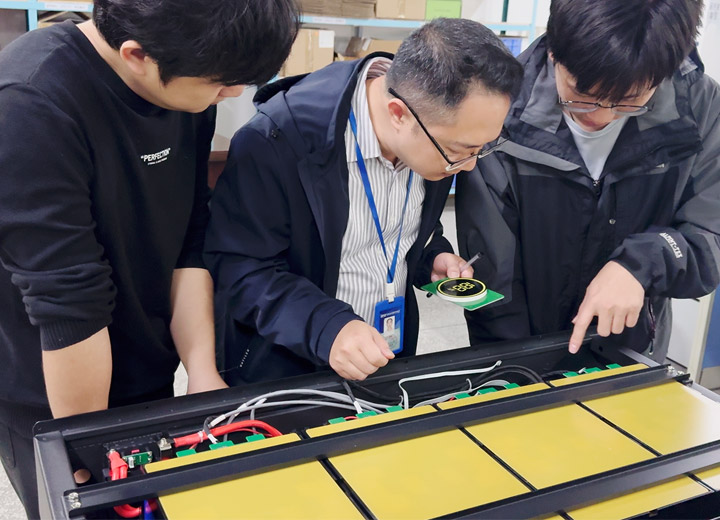

- Battery Management Systems (BMS): AI-powered BMS solutions enable real-time monitoring, fault diagnosis, and optimization of charging and discharging strategies.

- Digital Platforms: IoT connectivity integrates energy storage systems with cloud-based management platforms, enabling users to monitor energy usage, analyze returns, and enhance overall user experience through mobile apps.

II. Market Trends from the Demand Side

1. Residential Market: Rising Demand for Personalized Storage Solutions

- Electricity Price Volatility: In Europe, where the average electricity price reached €0.37/kWh in 2024, residential energy storage systems reduce electricity costs to approximately €0.12/kWh. As such, households increasingly turn to integrated solar and storage systems.

- Energy Independence: With frequent natural disasters and power outages, demand for off-grid systems is surging. In California, nearly 50% of new homes now incorporate energy storage systems for enhanced energy security.

2. Industrial and Commercial Sectors: Lowering Operational Costs

Energy storage systems are vital for peak shaving in the industrial and commercial sectors. In Germany, for example, peak demand charges account for 30% of total electricity costs, and energy storage systems can cut these charges by more than 50%. Additionally, they ensure uninterrupted power supply during production, boosting operational reliability.

3. Utility-Scale Applications: The Backbone of Grid Stability

As the share of intermittent renewable energy sources like wind and solar increases, grid-scale energy storage becomes indispensable.

- Balancing Renewable Energy Fluctuations: Storage systems help manage the surplus energy generated during the day and release it at night, addressing supply-demand imbalances.

- Large-Scale Projects: For instance, China’s State Grid is developing a 100MWh energy storage project and plans to reach 10GW of installed capacity by 2025.

4. Policy and Subsidy Support

- Global Incentives: Programs like the U.S. Inflation Reduction Act provide tax credits of up to 30% for energy storage projects.

- Local Policies: Regional subsidies and mandatory energy storage integration policies are accelerating market adoption.

5. Emerging Market Opportunities

Emerging markets in regions like Southeast Asia, India, and Africa are poised for rapid energy storage adoption. By 2025, the compound annual growth rate (CAGR) of energy storage markets in these regions is projected to exceed 25%, with distributed solutions leading the way.

III. Key Technology Outlook for the Energy Storage Industry

1. Hydrogen Energy Storage

Hydrogen storage is gaining traction as a complementary solution for long-duration storage, particularly in regions with high renewable energy penetration. Germany, for example, is advancing several “green hydrogen” projects to store excess electricity as hydrogen for flexible usage.

2. Sodium-Ion Batteries

Sodium-ion batteries are emerging as a cost-effective alternative to lithium-ion batteries due to abundant raw materials and lower costs. Companies like CATL plan to commercialize sodium-ion products by 2025, offering scalable solutions for medium- to large-scale energy storage.

3. Superconducting and Compressed Air Energy Storage (CAES)

In grid-scale storage, superconducting energy storage offers zero-loss performance, while CAES provides cost-effective, high-capacity options. Both technologies are rapidly gaining attention and investment worldwide.

IV. Summary and Future Forecast

1. Development Path of the Energy Storage Industry

The energy storage industry is transitioning from “high cost, low penetration” to “low cost, widespread adoption.” By 2030, energy storage system costs are expected to decrease by 30%, while total installed capacity will grow by over 200%.

2. Interaction Between Technology and Market

Technological innovations will redefine the boundaries of energy storage applications, while diverse market demands will drive further advancements in technology.

3. Future Outlook

The energy storage industry is entering a critical growth phase, with 2025 serving as a pivotal year. From advanced products to favorable market dynamics, energy storage systems will play a fundamental role in the global energy transition. Efficient, intelligent, and cost-effective storage solutions are set to integrate seamlessly into future energy systems, driving progress toward sustainable development goals.